9 Documents Tiny Home Buyers May Need for Approval

The tiny home movement has transformed from a niche lifestyle choice into a legitimate housing option, complete with its own financing structures, insurance requirements, and regulatory frameworks. While the homes themselves may be smaller, the paperwork needed to secure one can be surprisingly substantial. Understanding which documents lenders, insurers, and landowners require can mean the difference between a smooth approval process and frustrating delays that push your move-in date back by weeks or months.

Whether you're financing through a specialized tiny home lender, securing a personal loan, or arranging a land lease agreement, the documentation process shares similarities with traditional home buying but comes with its own unique twists. Here's what you'll likely need to gather before your tiny home dreams become reality.

Government-Issued Identification

Every approval process begins with proving who you are. Lenders and insurance companies require valid government-issued photo identification, typically a driver's license or passport.

Some institutions may request both a primary and secondary form of ID, particularly if you're applying for higher loan amounts or if there are any discrepancies in your application information.

Make sure your ID is current and that the address listed matches your other documentation. If you've recently moved or changed your name, update your identification before beginning the application process to avoid unnecessary complications.

Credit Report and History

Your credit profile tells the story of how you've managed financial obligations in the past, and it plays a central role in determining approval and interest rates. Most lenders will pull your credit report directly from the major bureaus, but reviewing your own credit beforehand allows you to identify and dispute any errors that could negatively impact your application.

Look for accounts that don't belong to you, incorrect payment histories, or outdated information that should have been removed. A credit score in the mid-600s or higher typically opens more doors for tiny home financing, though some specialized lenders work with buyers who have less-than-perfect credit.

W-2 Forms and Employment Verification

Traditional employees will need to provide W-2 forms from their current employer, usually covering the past two years. These forms corroborate the income listed on your tax returns and application.

Beyond the W-2s themselves, many lenders require an employment verification letter directly from your employer confirming your position, salary, and length of employment. This is where FormPros becomes valuable, as they offer templates and verification guidance that helps ensure your documentation meets lender requirements without unnecessary back-and-forth.

Having properly formatted employment verification from the start prevents the frustrating delays that occur when lenders reject inadequate documentation.

Bank Statements

Lenders want to see your financial stability through several months of bank statements, usually covering the most recent two to three months. These statements demonstrate your ability to manage money, maintain consistent balances, and handle regular expenses without overdrafting. They also verify that you have the funds needed for any down payment or deposit requirements.

If you're self-employed or have irregular income, be prepared to provide statements from all accounts where you receive deposits to give a complete picture of your financial situation.

.jpg)

Tax Returns

Two years of tax returns have become standard across most lending scenarios. These documents provide independent verification of your income and offer insight into your financial consistency over time.

If you've experienced significant income changes between years, be ready to explain the circumstances, whether that's a career transition, business growth, or recovery from a temporary setback.

Self-employed borrowers should ensure their tax returns reflect sufficient income to support the loan amount they're requesting, as lenders typically average income across the two years.

Profit and Loss Statements for Self-Employed Buyers

Self-employment brings additional documentation requirements. A year-to-date profit and loss statement prepared by a certified accountant carries more weight than self-prepared versions, though both may be acceptable depending on your lender. These statements should clearly show your business income, expenses, and net profit.

If your business is relatively new or has experienced volatility, supplementing P&L statements with client contracts, invoices, or letters from clients can strengthen your application by demonstrating ongoing business relationships and future income potential.

Insurance Documentation

Before finalizing any tiny home purchase, you'll need proof of insurance coverage. This typically comes in the form of an insurance binder, which serves as temporary proof of coverage while your full policy is being processed. Tiny home insurance can be complicated because these dwellings don't always fit neatly into traditional categories.

Some insurers classify them as RVs, while others offer specialized tiny home policies. The insurance binder must meet the lender's minimum coverage requirements and name them as the loss payee. Shopping for insurance early in the process prevents last-minute scrambles that could delay your closing.

Manufacturer and Serial Number Documentation

The serial number or VIN certificate for your tiny home serves a similar purpose to a vehicle title. This documentation proves the home's identity, verifies its manufacture date and origin, and allows for proper registration and titling.

If you're purchasing a used tiny home, ensure the serial number documentation is transferred correctly and that there are no liens against the property. Some jurisdictions require tiny homes to be registered similarly to RVs or manufactured homes, making this documentation essential for legal ownership.

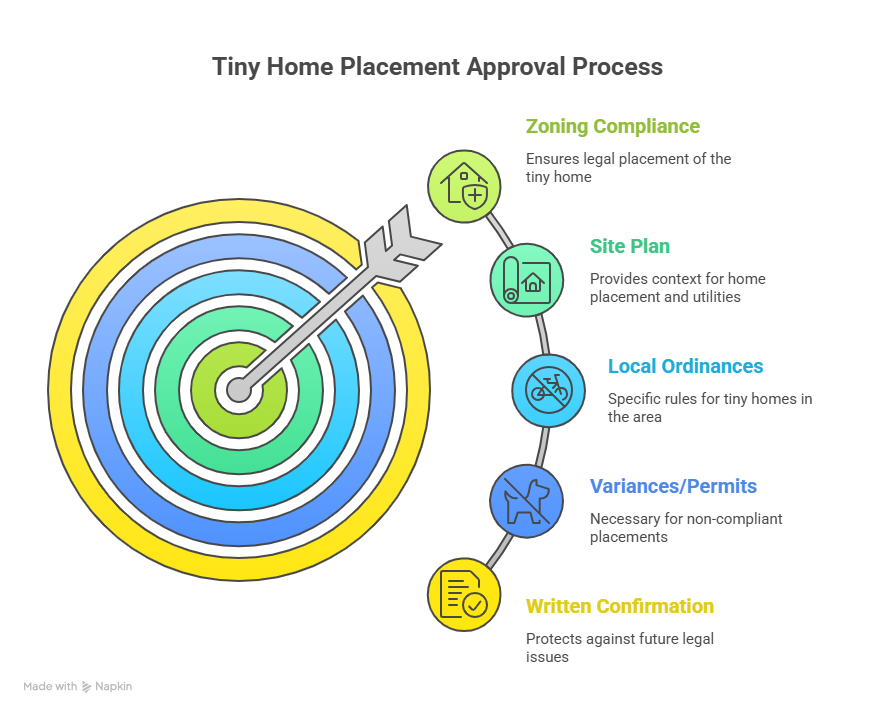

Site Plan and Zoning Compliance

Where you plan to place your tiny home matters significantly to both lenders and local authorities. A site plan showing exactly where the home will be positioned, how utilities will be accessed, and what the property boundaries look like provides crucial context for approval.

Additionally, a zoning compliance letter or statement from the local municipality confirming that your intended placement meets all zoning requirements protects everyone involved from future legal complications.

Some areas have specific tiny home ordinances, while others require variances or special permits. Obtaining written confirmation of compliance before purchase prevents the nightmare scenario of owning a home you cannot legally place anywhere.

Endnote

Gathering these documents before you begin the approval process puts you in the strongest possible position. The tiny home buying journey requires patience and attention to detail, but having your paperwork organized and complete helps you move through each stage efficiently and brings you that much closer to your simplified lifestyle.

.jpg)

.jpg)